Expanding internationally brings a major shift in financial management. Your accounting operations are no longer limited to euros. Between currency fluctuations, conversion differences and reconciliation challenges, many finance teams struggle to maintain a reliable view of their accounts receivable.

Managing multiple currencies should not become a constraint. Provided you rely on a solution capable of accurately reflecting accounting reality, from general ledger imports to outstanding amount tracking. This is precisely what multi-currency management is about.

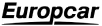

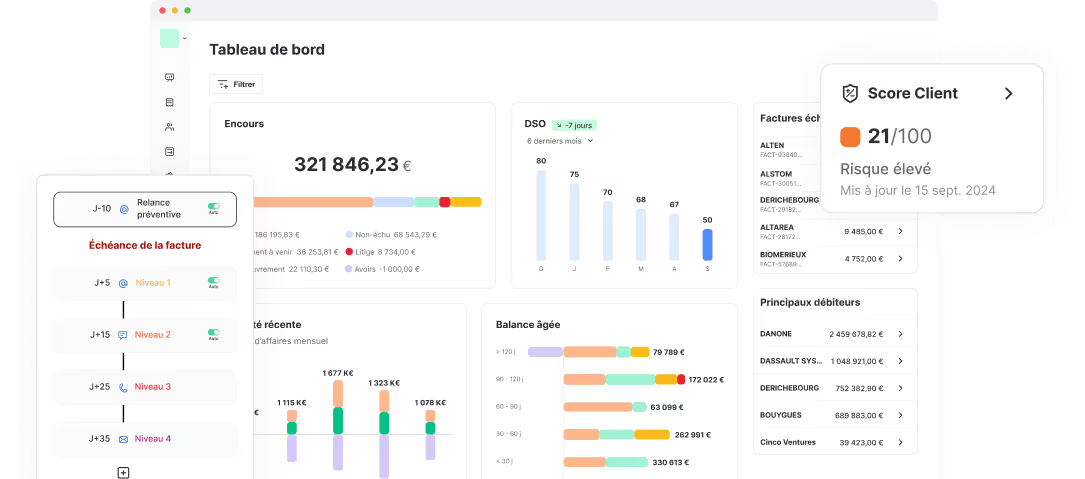

Implemented in just a few weeks before summer 2023 with a fully operational Sage 100 connector. Our group's goal of reducing DSO by 40% was achieved in less than a year thanks to Leanpay!

Bruno G. - CFO

Why multi-currency accounts receivable is a key issue for finance teams

As transactions multiply across different currencies, managing accounts receivable quickly becomes more complex. Amounts displayed in internal tools do not always match the general ledger, conversions vary depending on data sources, and teams spend a significant amount of time checking, adjusting or reprocessing critical financial data.

Beyond invoicing, multi-currency directly impacts the reliability of outstanding amounts, collection prioritisation, cash flow visibility and the ability to make informed decisions. Having accurate, consistent data aligned with accounting records becomes a fundamental requirement to secure international operations.

The limits of tools that do not truly support multi-currency accounting

In many solutions that do not fully handle multi-currency, amounts are automatically converted into euros. This often creates discrepancies in outstanding amounts compared to original accounting entries. Consolidation then becomes approximate: transactions in different currencies are aggregated without clear visibility on how exchange rates have been applied.

This lack of transparency makes figures harder to interpret and complicates the explanation of variances compared to original accounting amounts.

As a result, finance teams struggle to properly reconcile accounting, collections and financial reporting, losing valuable time reconstructing a reliable view from partial data.

How LeanPay manages multi-currency accounts receivable

Multi-currency management in LeanPay is designed to accurately reflect each company’s accounting reality. The goal is to allow you to work with original currencies, without automatic conversion, approximations or discrepancies with the general ledger.

Import general ledgers in their original currency

LeanPay allows you to import a general ledger whose main currency is not the euro. During setup, you select a default currency, which becomes the reference for all accounting operations within LeanPay.

This approach ensures that imported amounts remain consistent with the general ledger, without forced conversion or manual adjustments.

Manage accounting operations in a different currency

When an accounting operation is recorded in a currency different from the general ledger currency, an exchange rate is applied at the time of the initial import.

Two amounts are then associated with the transaction:

- the primary amount, in the original transaction currency;

- the secondary amount, converted into the general ledger currency.

This dual representation ensures full traceability between accounting data and LeanPay.

.png)

Consolidate amounts from different currencies

Some consolidated accounting entries group together several individual transactions, which may themselves be recorded in different currencies. LeanPay’s accounts receivable software then uses the amounts in the currency defined as the main currency in your LeanPay environment, ensuring a consistent view of consolidated totals.

The exchange rate applied remains the one used at the individual transaction level, guaranteeing exact alignment with your general ledger.

The concrete benefits of reliable multi-currency management

By displaying each transaction in its original currency and ensuring perfect alignment with the general ledger, LeanPay enables teams to work with accurate, actionable data. This precision directly improves how finance teams manage accounts receivable and analyse international activity:

- an accurate view of outstanding amounts, without distortions caused by automatic conversions;

- exact alignment with accounting records, even when multiple currencies are involved, notably through integrations;

- more reliable consolidation when several currencies apply to the same operation;

- clearer collection reporting, reducing interpretation issues and simplifying financial analysis;

- fewer manual adjustments, thanks to consistent data from the initial import;

- more secure management in an environment where currencies continue to multiply.

LeanPay helps you optimise debt collection internationally. Contact us to discover the features that can reduce DSO by at least 40 %.